Interim government of Bangladesh led by Nobel Laureate Prof Dr Muhammad Yunus runs the country now. This is the Fifth interim government of Bangladesh. First Caretaker Government was in 1990, second was in 1996, third was in 2001 and fourth was in 2007. Nobel Laureate Professor Dr Muhammad Yunus was sworn-in as the Chief Adviser of a 17-member interim government on 8 August 2024 four days after the resignation and departure of former Prime Minister Sheikh Hasina amid a mass upsurge led by students. He added another four Advisers in his pool on 17 August 2024.This Interim Government is consisted of Twenty One Advisers.

Chief Adviser Dr Muhammad Yunus said in his first televised address to the nation on 8 August 2024

On behalf of the nation, I urge everyone to step forward fearlessly in their respective workplaces, contributing their full capacity with enthusiasm and joy. All citizens of the country will have the right to fulfil their aspirations under this administration. Cooperate with us to achieve this goal.

Credible election after vital reforms

Dr Muhammad Yunus said while briefing the diplomats stationed in Dhaka on 14 August 2024, “We will hold a free, fair participatory election as soon as we can complete our mandate to carry out vital reforms in our election commission, judiciary, civil administration, security forces and media.”

He added, “We will undertake robust and far-reaching economic reforms to restore macroeconomic stability and sustained growth, with priority attached to good governance and combating corruption and mismanagement.”

About the interim government’s foreign policy Dr Yunus said in that meeting “Our government will nurture friendly relations with all countries in the spirit of mutual respect and understanding and shared interests,”

Life and Actions of Dr Muhammad Yunus

for betterment of Peoples’ Life and Livelihood

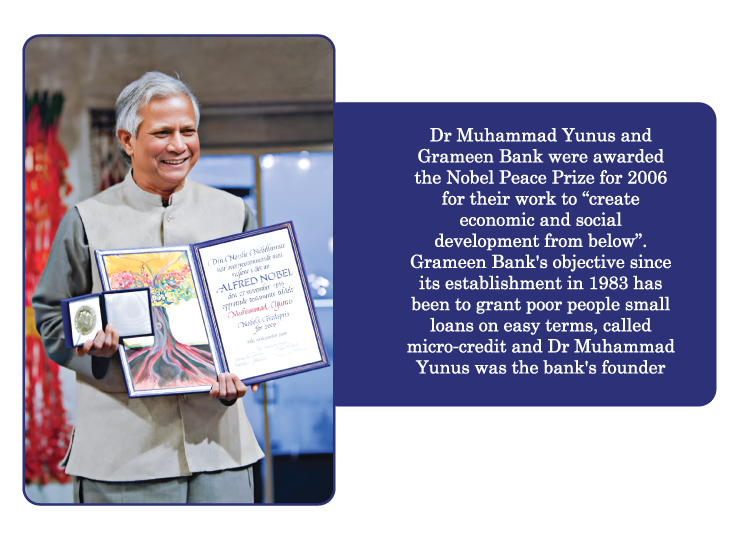

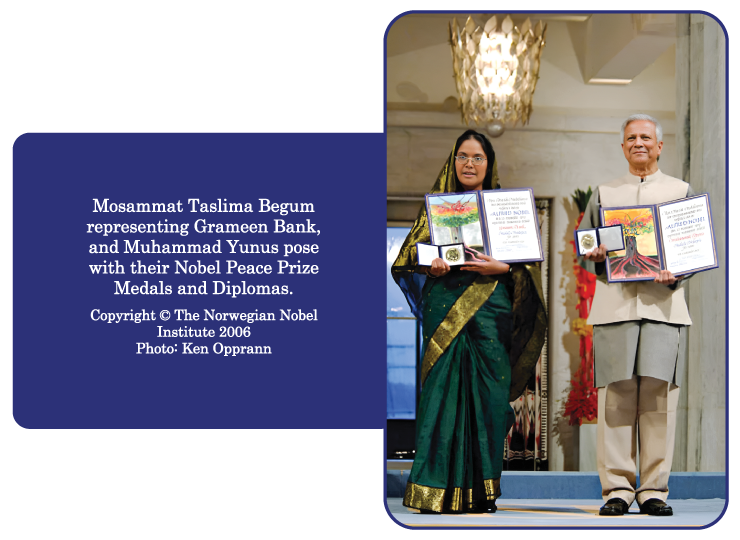

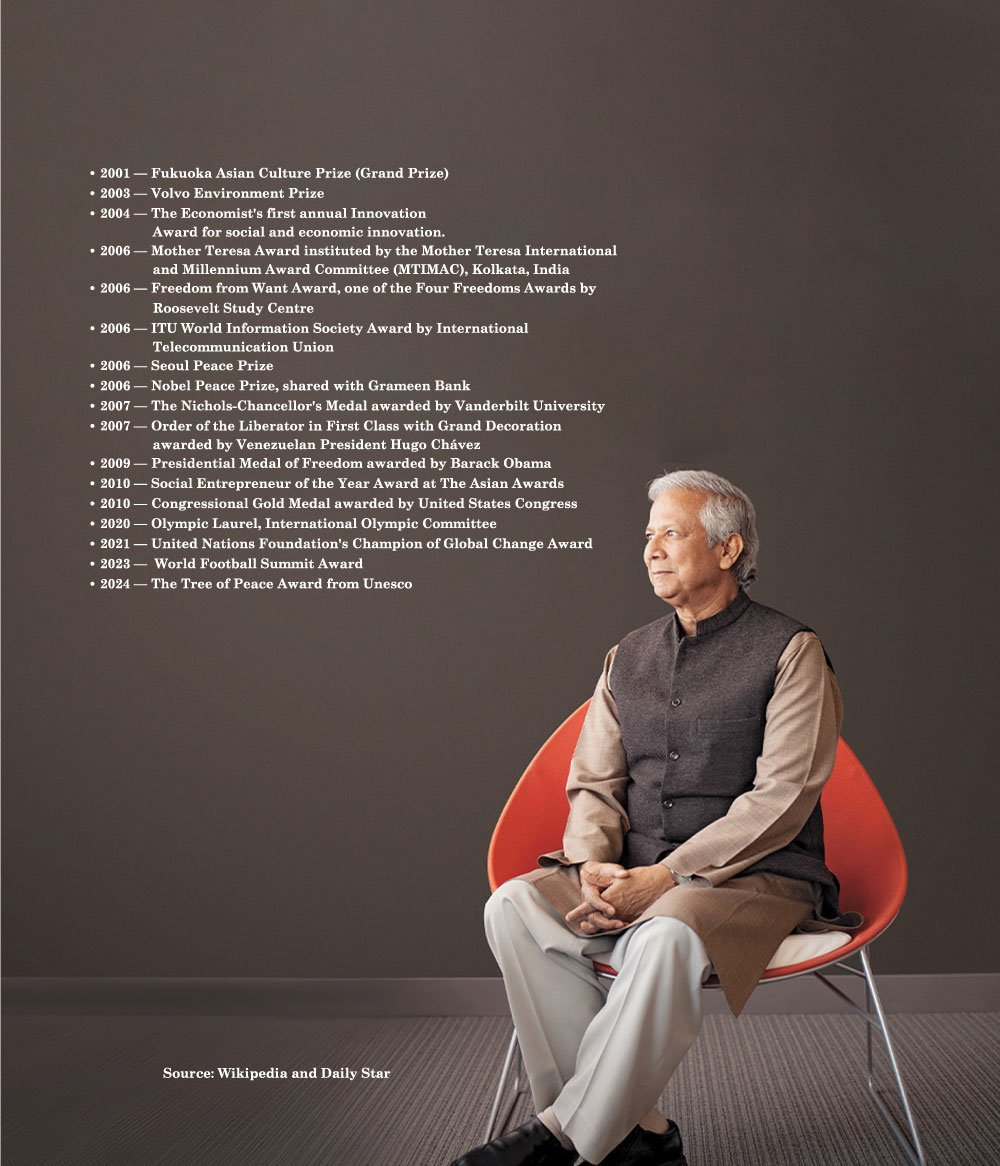

Nobel Laureate Dr Muhammad Yunus is the Chief Adviser of the Interim Government of Bangladesh since 8 August 2024. He is the only Nobel Laureate in Bangladesh. He was awarded the Nobel Peace Prize in 2006 for pioneering the concepts of microcredit and microfinance and founding the Grameen Bank.

Dr Yunus is one of just seven individuals who have been awarded the Nobel Peace Prize, the United States Presidential Medal of Freedom, and the United States Congressional Gold Medal. He received the United States Presidential Medal of Freedom in 2009, and the Congressional Gold Medal in 2010.

FAMILY

He was born on 28 June 1940 in Chittagong (now spell as Chattogram), Bangladesh. He was the third child of Hazi Dula Mia Shoudagar and Sufia Khatun. He spent his childhood in a village, but in 1944 his family moved to Chattogram.

During studying at PhD Program in the USA, there he met Ms Vera she was a daughter of Russian immigrants, she was studying Russian Literature at that University. They got married in 1970, but that marriage didn’t last long after the birth of their first child Monica. They were separated in 1979.

Dr Afrozi Yunus, second wife of Muhammad Yunus, hails from Laskar Dighi in Burdwan town, West Bengal, India and has been born and brought up in that town. She studied from Class III to X in Municipal Girls School in Burdwan town. She married Mohamad Yunus, when she was a Researcher at Manchester University in 1980. She was a professor at Jahangirnagar University in Bangladesh and taught Magnetic Physics. They have a daughter, Deena Yunus.

EDUCATION

He enrolled at the Lamabazar Primary School in Chattogram. Later, he studied in the Chittagong Collegiate School and he participated in Boy Scouts. He got an opportunity to travel to countries like West Pakistan, India, Europe, and the USA because of his participation in Boy Scouts. He has always been a meritorious student and 16th in Matriculation Examination out of 39,000 students in East Pakistan. After that, He enrolled himself in Chittagong College. He completed BA and MA in Economics from Dhaka University in 1960 and 1961 respectively, then received a Fulbright scholarship to study Economics at Vanderbilt University, USA He received his PhD in Economics from Vanderbilt University in 1969.

PROFESSIONAL LIFE

After finishing his undergraduate studies, he joined the Bureau of Economic Research as a Research Assistant under Economist Nurul Islam and Rehman Sobhan. Later, in 1961, he was appointed as a Lecturer in Economics at Chittagong College. Simultaneously, he set up a packaging factory. From 1969 to 1972, Yunus was an Assistant Professor of Economics at Middle Tennessee State University in Murfreesboro, USA.

After finishing his undergraduate studies, he joined the Bureau of Economic Research as a Research Assistant under Economist Nurul Islam and Rehman Sobhan. Later, in 1961, he was appointed as a Lecturer in Economics at Chittagong College. Simultaneously, he set up a packaging factory. From 1969 to 1972, Yunus was an Assistant Professor of Economics at Middle Tennessee State University in Murfreesboro, USA.

After the Liberation War of Bangladesh, he returned to Bangladesh and was appointed to the Planning Commission headed by Prof Nurul Islam. However, he found the job boring and resigned. Later he joined at Chittagong University as Head of the Economics department.

NABJUG (New Era) TEBHAGA KHAMAR (three share farm)

During the 1974 famine, as a research project, he established Nabajug (New Era) Tebhaga Khamar (three share farm), which the government later adopted as the Packaged Input Program.After observing the famine of 1974, he became involved in Poverty Reduction and established a rural economic program as a Research Project. In 1975, he developed a Nabajug (New Era) Tebhaga Khamar (three share farm) which the government adopted as the Packaged Input Program.

GRAM SARKAR (Village Government)

To make that project more effective, Dr Yunus and his associates proposed the Gram Sarkar (the village government) program. Introduced by President Ziaur Rahman in the late 1970s, the government formed 40,392 village governments as a lowest tier of Government in 2003. On 2 August 2005, in response to a petition by Bangladesh Legal Aid and Services Trust (BLAST), the High Court of Bangladesh declared village governments illegal and unconstitutional.

GRAMEEN BANK RUNS a global movement of microfinance

In 1976, Dr Yunus took matters into his own hands under as an Action Research pilot project in “Jobra” village in Chattogram district of Bangladesh, loaning very small sums of money, reportedly equivalent to $27, to 42 local women who needed to buy materials to produce their products. Traditional banks wouldn’t offer loans or lines of credit to people without collateral. But Dr Yunus believed that the very poorest could raise their own small business activity and microcredit and microloans support could address their need.

That concept of Microcredit would lead him toward the beginnings of forming the Grameen bank. Yunus began borrowing money from other banks to make loans to the poor, initially as part of a pilot program that ran from 1976 to 1983.

In 1983, he formally opened the Grameen (Village) Bank, which served as a way to offer microcredit to entry level and subsistence entrepreneurs. This Bank was established under the Grameen Bank Ordinance 1983. As per the Ordinance, the objective of this bank is to provide credit facility to the landless poor people of the rural areas.

The unique feature of Grameen Bank is that no collateral is required to get the credit from the bank. Unlike mainstream commercial banks that bring their clients to their shiny branch premises where the poor are afraid to be trampled, It carries its services to the comfort zone of its clients’ doorsteps. It has inspired the women and the weaker section of the communities to join the Grameen fraternity. All banking transactions except loan disbursement are done in the meetings of the borrowers at the village level centers organized by the center managers.

In the initial years, donor agencies used to provide the bulk of capital at low rates. By the mid 1990s, Grameen Bank started to get most of its funding from the central bank of Bangladesh. More recently, Grameen has started bond sales as a source of finance. The bonds are implicitly subsidized, as they are guaranteed by the Government of Bangladesh, and still they are sold above the bank rate.

In 2013, Bangladesh parliament passed ‘Grameen Bank Act’ which replaces the Grameen Bank Ordinance, 1983, authorizing the government to make rules for any aspect of the running of the bank.

Scholarship Program

Grameen Bank introduced a scholarship program in 1999 for encouraging the schooling of Grameen children, so that, children from poor families stay in school, and complete both academic and extracurricular activities. Priority is given to girls.

Each year scholarships are given in five categories: Primary, Junior Secondary, Secondary School Certificate (SSC), Higher Secondary Certificate (HSC) and Cultural. At least 50% of the scholarship money must go to girls and the remaining 50% go to both boys & girls based on overall performance. Around 27,000 scholarships are awarded each year and the awardees receive monetary support for one year.

Each year scholarships are given in five categories: Primary, Junior Secondary, Secondary School Certificate (SSC), Higher Secondary Certificate (HSC) and Cultural. At least 50% of the scholarship money must go to girls and the remaining 50% go to both boys & girls based on overall performance. Around 27,000 scholarships are awarded each year and the awardees receive monetary support for one year.

Struggling Member (Beggar) Program

Beggars are the hardest to reach under the conventional poverty alleviation program. To capture this group Grameen Bank took an innovative scheme in 2002 called Struggling Members Program. The objective of the program is to provide financial services to the beggars to help them find a dignified livelihood, become regular members of Grameen Bank, send their children to school and make them graduate. Among the beggars, there are disabled, blind, and retarded people, as well as old people with ill health. Over 115,042 beggars have joined the program. As of November 2023, the total amount disbursed stood at BDT 188.07 million (USD 2.73 million). Of this amount, BDT 162.19 million (USD2.31 million) has already been repaid.

grameen trust

YUNUS CENTRE

The Yunus Centre, in Dhaka, Bangladesh is a think tank for issues related to social business, working in the field of poverty alleviation and sustainability. It is ‘aimed primarily at promoting and disseminating Professor Yunus’ philosophy, with a special focus on social business’.

Activities

Poverty-Free World campaign

Yunus Centre is working to promote the United Nations Millennium Development Goals in Bangladesh and all around the world and is especially committed for making Bangladesh free of poverty by 2030.

Research and publications

Disseminating the ideas and philosophy of Prof. Yunus on social business and microfinance.

Social business

Acting as the primary source of information on social businesses worldwide and providing consulting services to start-ups.

Academic programs

Developing curricula for classes on

social business. Amongst other, current partnerships exist with Harvard University, HEC (Paris), the Asian Institute of Technology (Bangkok), Bocconi University (Milan) McGill University (Montreal), Glasgow University, University of Florence and University of Salford.

Grameen Telecom: A Beacon of Women Empowerment in Rural Bangladesh

With success of microcredit program with rural poor, Prof Muhammad Yunus came up with an idea to set up at least one publicly available phone in one village to serve the necessary demand of telephone services by extending Grameen Phone net work to cover all villages of Bangladesh. This phone was made available to public for a fee by a Grameen Bank borrower known as Telephone Lady.

Grameen Telecom, a pioneering force in the realm of rural technology development, stands as a testament to the transformative power of connectivity for rural women. Established in 1997, Grameen Telecom, as a Social Business (a not-for-profit Company), has been instrumental in bridging the digital divide and fostering socio-economic progress in remote communities across Bangladesh and became the pioneer in the whole world.

Grameen Telecom launched its fascinating program, Village Phone on 26 March 1997, with a vision to bridge the technological gap between urban and rural Bangladesh through affordable mobile technology. This program was uniquely designed only for Grameen Bank borrowers.

Village Phone was also introduced as a unique tool to alleviate poverty with entrepreneurship skills of Grameen Bank female members.

Village Phone program launched with only 24 subscribers in 1997 . Now the widespread availability of mobile technology and service makes mobile phone available to anybody anywhere in Bangladesh.

GRAMEEN TELECOM TRUST (GTT)

Grameen Telecom Trust (GTT) is an entity for implementing and facilitating Social Business ideas. It strives to transform societies through Social Business and was formed in 2010 under the Trust Act Once innovative ideas relating to the field are set forth, GTT formulates them in to prototypes that can be replicated in a sustainable manner. Through practical realization of Social Business ideas it envisions in achieving a world without poverty.

Nobin Udyokta-NU (New Entrepreneur) Program

Nobin Udyokta-NU (New Entrepreneur) Program is a youth entrepreneurship development program for the next generation of Grameen family to turn unemployment into entrepreneurship. It is aimed for the children of Grameen Bank members aged between 18 to 35 years. The aged limit is relaxed for females to encourage more female entrepreneurs.

Social business Learning and Innovation Fund

Encouraging innovative enterprises to reduce social problems and supporting social business models through learning by doing approach on a pilot basis. It has been created to encourage innovative enterprises to undertake social business. It intends to support social business models through learning by doing approach on a pilot basis. The proposed modes of funding these social businesses include: project financing, equity financing, working capital financing, joint venture or 100% Grameen Telecom Trust (GTT) ownership etc.

Grameen Health Care Services

Grameen Health Care Services Limited (GHS) is a social business enterprise established in 2006. Investors in this company are Grameen Telecom Trust (GTT), Grameen Kalyan (GK) and Grameen Shakti (GS). The main objectives of the company are to establish and operate hospitals, healthcare centers and mobile health clinics, pathological centers or labs for assuring quality healthcare services. It also aims to undertake necessary measures for identifying people (with emphasis on children) suffering from diseases in rural areas.

Grameen Fabrics and Fashion

Grameen Fabrics and Fashion Limited (GFFL) is a social business company fully owned by Grameen Telecom Trust. It aims at successfully establishing the concept of social business and eliminate social problems such as unemployment and poverty. With the completion of an industrial park named ‘Social Business Industrial Park. The company strives to establish its products in local and international markets.

Grameen Distribution Limited

Grameen Distribution Limited (GDL) is a sales and marketing based company in Bangladesh with a nation-wide presence. The company has a range of products in mobile handsets, energy efficient products, healthcare products and some other general consumer goods.

Samajik Convention Centre

Samajik Convention Centre is a modern state of the art facility for conference, exhibition, wedding etc. located in the heart of Zirabo, Ashulia. The objective of the project is to create skilled manpower through hospitality management training who will gather practical experience in the convention centre and 3-star hotels.

Samajik Health Science Institute & Research Centre

Samajik Health Science Institute & Research Centre (SHSIRC) runs with objectives to provide healthcare and education facilities to those economically challenged at subsidized prices. 500-Bed Hospital and Medical College, Caledonian College of Nursing with Hostel facilities and Samajik Health Science and Research Institute are projects of this center.

The Grameen Group and Groupe DANONE joined forces since March 2006 to create Grameen Danone Foods Ltd, a social business based in Bangladesh. This company is the first investment supported by ‘Danone Communities’, an investment fund, created to support businesses that aim to be sustainable, but make social and societal goals their objective.

Caledonian College of Nursing with Hostel facilities (GCCN)

GCCN is the largest and one of the leading Nursing colleges in the private sector of Bangladesh approved by the Ministry of Health & Family Welfare, Bangladesh Nursing and Midwifery Council and University of Dhaka, established in 2010. It is a successful partnership between Glasgow Caledonian University (UK) and Grameen Health Care Services. GCCN provides education at international standards along with a culture that promotes personal development. Students are exposed to an environment where they are encouraged to develop their self-confidence and self-esteem as well as scientific knowledge of nursing and health care.

Nobel Peace Prize for 2006